does texas have a death tax

No not every state imposes a death tax. The estate tax sometimes referred to as the death tax is a tax levied on the estate of a recently deceased person before the money passes on to their heirs.

Jake Riley On Twitter Tax Haven Offshore Makeover

Texas does not levy.

. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. Married couples can shield up to. It has no effect until the owners death.

On the one hand Texas does not have an inheritance tax. In 2011 estates are exempt from paying taxes. This means that if a person passes away on June 1 2009 that persons final income tax return will cover only the period from January 1.

As of 2022 if an individual leaves less than 1206 million to their heirs they wont have to worry about paying any federal estate tax in the US. These federal estate taxes are paid by the estate itself. At the owners death a transfer on death deed conveys the real property subject to any mortgages liens or other encumbrances.

Then the estate must pay the taxes interest and penalties. Prior to September 15 2015 the tax was tied to the federal state. There is a 40 percent federal tax however on estates over 534.

Tax was permanently repealed effective as of September 15 2015 when Chapter 211 of the Texas Tax Code was repealed. A persons death terminates his or her taxable year. Only 12 states plus the District.

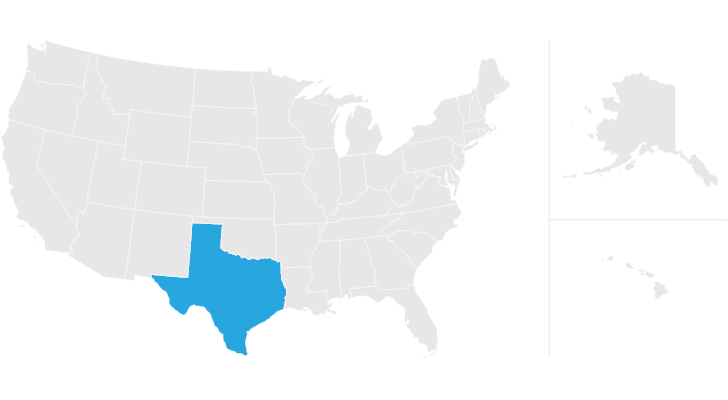

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that. There is a Federal estate tax that applies to estates worth more than 117 million.

Taxes levied at death based on the value of property left behind. Does texas have a death tax Friday July 1 2022 Edit. The federal government eliminated inheritance taxes and instituted an estate tax policy that most states including Texas follow.

A federal estate tax is a tax that is levied by the federal government and that is based on the net value of the decedents estate. Does every state impose a death tax. Texas does not have an.

So long as the decedents estate is valued at less than the applicable exemption amount for the. Then the estate must pay the taxes interest and penalties. Estate taxes and inheritance taxes.

The taxes plus interest plus a penalty keep adding up until the elderly or disabled homeowner dies. There are two main types of death taxes in the united states. There is a 40 percent federal tax however on estates over 534.

However a Texan resident who inherits a property from a state that does have such tax will still be responsible.

Texas Estate Tax Everything You Need To Know Smartasset

Black Slaves As A Percentage Of The Total Population Of Texas In 1840 Texas History Slaves Texas

Sample Texas Residential Lease Agreement Printable Lease Agreement Rental Agreement Templates Being A Landlord

Texas Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Real Estate Exam Cheat Sheet Real Estate Exam Real Estate Test Real Estate Business Plan

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Texas Estate Tax Everything You Need To Know Smartasset

Texas Inheritance Laws What You Should Know Smartasset

Are You Over 65 Do You Have Both Your Homestead And Over 65 Exemption In Place Know More About Texas Homestead Exemption Rules M Protest 65th Tax Exemption

What Is The Probate Process In Texas A Step By Step Guide

City Of Rowena Bonnie N Clyde Bonnie Parker Bonnie Clyde

Texas Inheritance Laws What You Should Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die